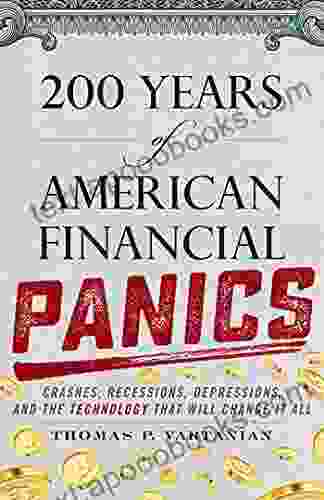

200 Years of American Financial Panics: A Window into Market Meltdowns and Economic Crises

Throughout history, the United States has witnessed a series of financial panics that have rocked the nation's economy and left an indelible mark on its financial landscape. From the Panic of 1819 to the Great Recession of 2008, these market meltdowns have shared striking similarities and have taught valuable lessons about the fragility and resilience of the financial system.

The Common Threads: Triggers and Consequences

Despite their unique circumstances, American financial panics have often been triggered by a combination of factors, including:

4.6 out of 5

| Language | : | English |

| File size | : | 7302 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 481 pages |

| X-Ray | : | Enabled |

- Excessive speculation and credit expansion: When investors and businesses borrow heavily and invest aggressively, it can create a bubble that eventually bursts.

- Financial instability and bank failures: Weak banks and financial institutions can spread panic and trigger a domino effect, leading to widespread economic disruptions.

- External shocks and economic downturns: Major events, such as wars or natural disasters, can shock the financial system and trigger a downturn.

The consequences of financial panics can be far-reaching:

- Economic recession or depression: Panic-driven sell-offs and loss of confidence can lead to a sharp decline in economic activity and widespread unemployment.

- Loss of wealth and savings: Investors and savers can lose significant amounts of money as asset values plummet.

- Social unrest and political instability: Economic distress can fuel social discontent and lead to political instability.

Exploring Notable Financial Panics

Some of the most significant financial panics in American history include:

- The Panic of 1819: The first major financial crisis in the United States, triggered by over-speculation in land and the collapse of the Second Bank of the United States.

- The Panic of 1837: A speculative boom and financial excesses led to a widespread banking crisis and economic depression.

- The Panic of 1857: Triggered by a decline in railroad construction and over-leveraged businesses.

- The Panic of 1873: A combination of factors, including the failure of the banking firm Jay Cooke & Company and the Long Depression.

- The Panic of 1893: Caused by bank failures and a sharp decline in silver prices.

- The Panic of 1907: Triggered by a run on banks and a shortage of liquidity in the financial system.

- The Great Depression (1929-1939): The most severe financial crisis in American history, caused by a combination of factors, including the stock market crash of 1929 and unsustainable economic policies.

- The Savings and Loan Crisis (1980s-1990s): A crisis in the savings and loan industry, driven by deregulation and risky lending practices.

- The Global Financial Crisis (2008-2009): A worldwide financial crisis sparked by the collapse of the subprime mortgage market and the failure of the investment bank Lehman Brothers.

Lessons Learned from Financial Panics

By examining the history of financial panics, we can gain valuable insights into the nature of financial markets and the importance of:

- Maintaining financial stability: Regulating the financial industry and ensuring the soundness of banks is crucial for preventing financial crises.

- Managing risk and avoiding excessive leverage: Investors and businesses should be cautious about taking on too much debt and should diversify their investments.

- Promoting economic growth and stability: Governments have a role to play in fostering economic growth and stability, while avoiding policies that create bubbles or unsustainable economic conditions.

The history of American financial panics is a sobering reminder of the fragility of the financial system and the importance of understanding its vulnerabilities. By studying these past crises, we can better equip ourselves to identify and mitigate the risks of future financial meltdowns and ensure a more stable and prosperous economy.

For a comprehensive and in-depth exploration of American financial panics, I highly recommend the book "200 Years of American Financial Panics: A History of Speculation, Crisis, and Greed" by Charles Calomiris and Stephen Haber. This highly acclaimed book provides a detailed analysis of these market upheavals, offering valuable insights into their causes, consequences, and lessons learned.

Embark on this fascinating journey through financial history, and gain a deeper understanding of the forces that shape our economy and the importance of financial stability.

4.6 out of 5

| Language | : | English |

| File size | : | 7302 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 481 pages |

| X-Ray | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Kory M Shrum

Kory M Shrum Kristie Lynn Higgins

Kristie Lynn Higgins Paul H Lewis

Paul H Lewis Lee Conrad

Lee Conrad Osnat Ben Ami

Osnat Ben Ami Violet Howe

Violet Howe Ziyu Huang

Ziyu Huang Veda Boyd Jones

Veda Boyd Jones Kvaala

Kvaala Laurie S Sutton

Laurie S Sutton Kristen Proby

Kristen Proby L C Shaw

L C Shaw Rosemary Clark Parsons

Rosemary Clark Parsons Nelson Zink

Nelson Zink R John Brockmann

R John Brockmann Penelope Mortimer

Penelope Mortimer Michael Yates Jr

Michael Yates Jr Tristan Tuttle

Tristan Tuttle Oliver Eagleton

Oliver Eagleton Susan Gillis

Susan Gillis

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Ralph Waldo EmersonDiscover the Fascinating World of Pygmy Goats: A Comprehensive Guide to...

Ralph Waldo EmersonDiscover the Fascinating World of Pygmy Goats: A Comprehensive Guide to... Dylan HayesFollow ·15.5k

Dylan HayesFollow ·15.5k Charlie ScottFollow ·10.8k

Charlie ScottFollow ·10.8k Nathan ReedFollow ·4.2k

Nathan ReedFollow ·4.2k Duane KellyFollow ·14.7k

Duane KellyFollow ·14.7k H.G. WellsFollow ·12.7k

H.G. WellsFollow ·12.7k Floyd PowellFollow ·4.5k

Floyd PowellFollow ·4.5k Eddie PowellFollow ·13k

Eddie PowellFollow ·13k W.H. AudenFollow ·16.7k

W.H. AudenFollow ·16.7k

Henry Wadsworth Longfellow

Henry Wadsworth LongfellowUnleash the Blues Spirit: Dive into "Blues Guitar Songs...

The captivating allure of the blues has...

Ernesto Sabato

Ernesto SabatoBehind the Scenes with the Legends of Beauty

Unveiling the...

Neal Ward

Neal WardUnleash the Infernal Power of "Lucifer's Hammer" by Larry...

A Cosmic Catastrophe that Will Ignite Your...

Wesley Reed

Wesley ReedPetra Pecado: A Gripping and Unforgettable Journey...

Embark on a Captivating Adventure ...

Phil Foster

Phil FosterStep into a World of Wonders: Footfall by Larry Niven - A...

Prologue: In the vast expanse of the...

4.6 out of 5

| Language | : | English |

| File size | : | 7302 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 481 pages |

| X-Ray | : | Enabled |